GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

For SMBs in Australia, BAS submission is not just a mere legal requirement but an essential process for those who want a stable and efficient business. Regardless of the type of business you’re running, be it a sole trade, a startup or a growing enterprise, it is essential for you to keep track of the BAS due dates as well as the BAS payment dates so that you do not have to face penalties and poor cash flow.

The Australian Taxation Office (ATO) expects most GST-registered businesses to submit a BAS monthly, quarterly, or annually, based on the business turnover and reporting requirements. In most cases, the BAS submission due dates are quarterly, but whenever you miss even one of them, it will lead to extra costs and hardship.

This blog post outlines the basics about the BAS for the years 2025 and 2026, including the BAS return due date and ATO quarterly BAS due dates, yet also provides useful advice on how to be more compliant and avoid major penalties. Whether you prepare your lodgement internally or delegate it to a registered BAS agent, this guide will assist you in always being prepared and never stressed – at least, not about BAS compliance – at the last minute.

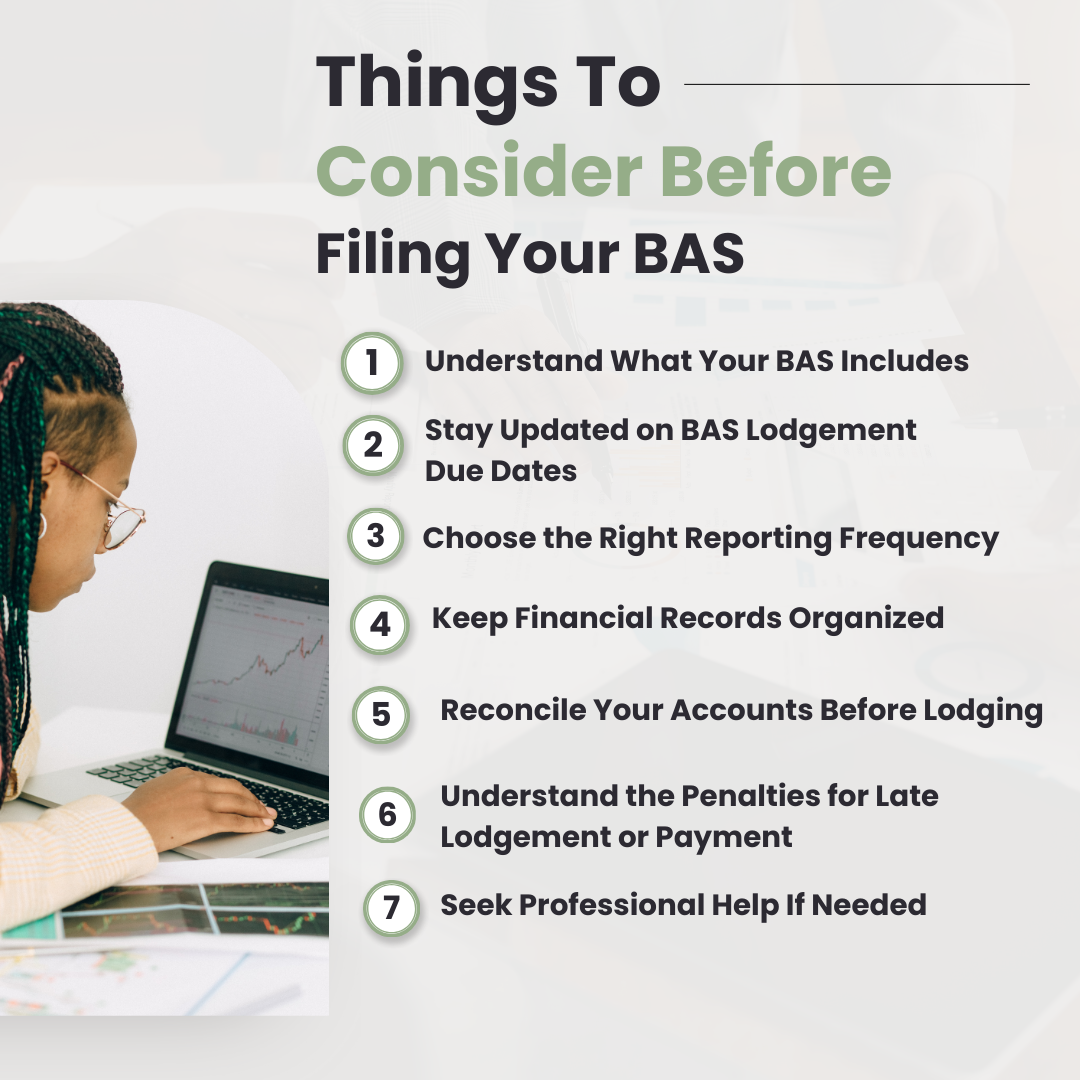

Here are the things before filing your BAS lodgements:

First of all, one must be very clear as to what should be included in BAS. It typically includes:

Goods and Services Tax (GST)

Pay As You Go is a method of withholding tax whereby amounts are deducted at the source to the tax office, with the remaining to be paid to the employee.

PAYG instalments

Fringe Benefits Tax (FBT) instalments

Wine Equalisation Tax (WET) and Luxury Car Tax (LCT), if applicable

It is worth noting that each BAS submission differs depending on the business type and size. If these elements are not properly recorded or reported, failure could lead to disparities or penalties for the respective business. The BAS needs to be lodged, and it is only effective when the information to be submitted is well understood and prepared.

Penalties and interest costs may also be incurred for failing to meet BAS lodgements while the company’s reputation suffers with the Australian Taxation Office (ATO). a) Below are the ATO's recent quarterly BAS due date for the financial year 2024-2025:

|

Quarter |

BAS Period |

Standard Due Date |

With Tax BAS/Agent |

|

Q1 |

1 July – 30 September |

28 October |

25 November |

|

Q2 |

1 October – 31 December |

28 February |

28 February |

|

Q3 |

1 January – 31 March |

28 April |

26 May |

|

Q4 |

1 April – 30 June |

28 July |

25 August |

Such BAS payment due dates for BAS apply whether you lodge manually, electronically or through an agent. However, it is pertinent to mention the fact that engaging a BAS or tax agent is likely to enable you to get an extended deadline, which is always useful when you are conducting a business.

BAS can also be filed monthly, quarterly, or annually, depending on your business's GST turnover.

Monthly: For businesses with GST turnover of $20 million or more

Quarterly: Most small businesses fall under this category

Annually: If voluntarily registered for GST and turnover is under $75,000

It is equally important to understand your correct reporting frequency so as not to select the wrong frequency, which may cause you to have mismatched BAS statement due dates or to submit the wrong tax return.

The following entries should be incorporated into your records in order to file BAS returns accurately, especially in terms of the dates;

All tax invoices

Payroll summaries and PAYG records

Bank statements

Expense receipts

This means that there is software which can be used on the cloud for accounting calculations and can also inform about BAS due dates. Book-keeping also shows that when it is time to file, one will not be searching for documents at the last minute.

Before preparing your BAS, clear your GST and PAYG accounts. This process step will increase the chances that the figures in your return align with the records held by the ATO and avoid any adjustments or complications arising during an audit.

BAS is filed based on lodgement due dates, and reconciling beforehand avoids entering figures in the wrong account or leaving out something important in the final computation of tax that must be paid to the government.

The ATO also has penalty units for late BAS payment due dates or statements. These penalties translate to higher operating costs for small businesses, especially if they often pay in arrears or understate taxes due to underestimations. To remain compliant with the BAS and prevent receiving a bill for some audited BAS, it is beneficial to outsource your BAS to a registered BAS agent.

If the BAS process described above seems burdensome, please note that you are only human. More and more business owners in Australia have contracted professional help for BAS preparation to relieve stress and meet all the BAS lodgement submission deadlines. BAS professional arrangements guarantee that BAS is lodged correctly, is lodged when it should be lodged and meets ATO requirements.

BAS due dates of the quarter for years 2025 and 2026 vary depending on the lodgement cycle. For most businesses filing the BAS quarterly, the ATO expects you to submit and pay by the 28th of the following month to the one in which the quarter closes. This means:

The first quarter reporting period of calendar year 2025, namely ending September 2025, is due on 28 October 2025.

The second quarter results (October to December of the year 2025) are due to be presented by 28 February of the following year.

We are, therefore, expecting the third quarter for the year ended 31 December 2025 (Jan–Mar 2026) to be filed by 28th April 2026.

The fourth quarter (April to June of the year 2026) is expected to be sent before the 28th of July, 2026.

Please check these BAS lodgement due dates on the ATO website (because you can lodge through a BAS agent, so they may be qualified to submit the ATO quarterly BAS due date).

The ATO, however, may apply late lodgement penalties if the BAS has not been lodged on time as indicated below. This can also have an impact on the records of your taxes and your compliance. It’s always advisable to submit BAS before the due dates of the BAS statement, and in the event that one has a tendency to miss the deadline, one should consult with the BAS agent or the ATO for an extension.

The BAS payment deadlines follow its lodgement deadlines, which are usually on the 28th of the subsequent month, on the particular financial year’s quarter end. Many of the companies make payments to their suppliers or for their services from the vendors, and these payments should be made within the required time to avoid the extra interest cost. To minimize the chances of missing the BAS deadline, you should allow for direct debit, BPAY or use the ATO online services.

Yes. Even if you did not have any income or expense in the relevant period, it is mandatory that you file the nil BAS for your business. This helps you submit your BAS on time and within the legal requirements of the Australian tax law. This may result in automatic reminders, non-lodgement notices, or penalties may be imposed by the ATO.

To ensure you do not miss your BAS lodgement dates or due dates for BAS payments, you can make use of the online business rather than go for a registered BAS agent. Some of the accounting software also has features that include reminders and calendars, which you need to use to assist when it comes to remembering various BAS quarterly dates for the submissions.

Special characters are not allowed.

Special characters are not allowed.