GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

As your business evolves, so do its internal responsibilities—and payroll, though seemingly straightforward, is one of the most time-sensitive and regulation-heavy functions you must manage. Errors can bring fines, employee dissatisfaction, and reputational damage. On the other side, investing in a good in-house payroll system can be costly and resource-draining. This is where outsourcing payroll enters the scene as a strategic move rather than just a cost-saving mechanism.

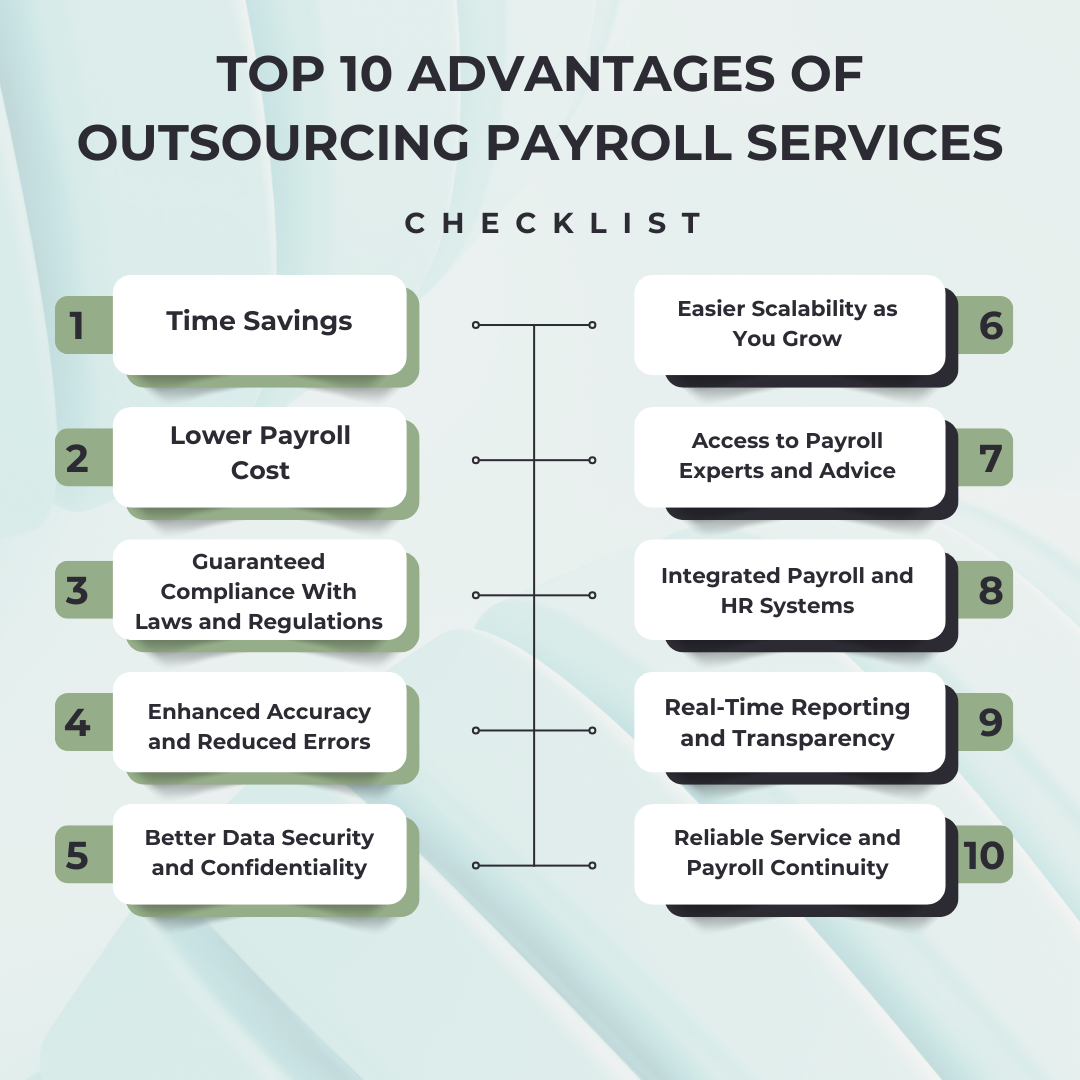

In this in-depth blog, we explore the top 10 benefits of outsourcing payroll services and balance them with the 5 key disadvantages you should consider. Whether you're a small startup, a growing business, or an established company looking to scale efficiently, this blog is your roadmap to making informed decisions about payroll outsourcing.

Payroll outsourcing refers to delegating your company’s payroll functions to a specialised third-party service provider. These providers take care of everything—calculating wages, managing tax deductions and remittances, producing payslips, maintaining compliance, filing reports, and sometimes even handling year-end processes like W-2 or T4 summaries.

Rather than treating payroll as a task to be completed every pay cycle, many businesses now view it as a potential source of competitive advantage when handled efficiently and compliantly with expert support.

Businesses that outsource payroll can reduce processing costs by up to 18% compared to in-house teams, according to Deloitte’s Global Payroll Benchmarking Survey.

1. Time Savings: Processing payroll is not just a weekly or bi-weekly task. It involves tracking employee hours, verifying records, calculating payments, updating tax codes, and submitting multiple reports. Even for a small business, this can take up 10 to 15 hours a month.

When you outsource payroll, this time is given back to your team, allowing HR, finance, and management to focus on strategic business tasks like employee development, financial planning, or core operations.

|

Pro Tip: Track your internal payroll hours for one month. You’ll gain visibility into hidden productivity costs. |

2. Lower Payroll Costs: Managing payroll in-house involves direct and indirect expenses—hiring payroll professionals, purchasing licensed software, conducting regular training, and investing in compliance systems. These costs escalate with every new hire or tax change.

With outsourced payroll services, you can expect a clear, transparent monthly fee with fewer surprises. There’s no need to worry about software renewals or hidden upgrade charges.

|

Suggestion: Use a cost calculator to compare internal payroll management vs. outsourcing. You may discover a 25-30% reduction in total payroll costs. |

3. Guaranteed Compliance With Laws and Regulations: Employment laws are constantly evolving. One missed update in tax rates, superannuation caps, or labour laws could lead to penalties, audits, or employee disputes.

By partnering with a professional payroll provider, you tap into experts who monitor and implement legal changes proactively, ensuring compliance across the board—from minimum wage updates to reporting deadlines.

|

Advice: Choose a provider with experience in your region or industry. Local knowledge is critical in payroll compliance. |

4. Enhanced Accuracy and Reduced Errors: Payroll errors damage employee trust and may result in government fines or back payments. Issues like incorrect deductions, late payments, or overpayments can create long-term financial and legal trouble.

Most payroll outsourcing services operate with automated systems and checks to ensure every number is accurate before payroll is finalized.

|

Pro Tip: Choose a provider that allows you to preview and verify payroll reports before final processing. |

5. Better Data Security and Confidentiality: Employee payroll data is highly sensitive—it includes salary details, tax information, addresses, and bank account numbers. A minor breach could have serious reputational consequences.

Outsourced providers invest in advanced security infrastructure, such as multi-factor authentication, role-based access controls, and encrypted cloud storage, to protect client data.

|

Security Highlight: Ask your provider about their ISO certifications and data breach response policy. |

6. Easier Scalability as You Grow: As your team grows, payroll complexity increases. New hires, part-timers, freelancers, and contractors often have unique payroll structures.

With outsourced payroll, adding new team members is a breeze. There’s no need to buy new software or train staff—the provider scales with your business.

Ask if the provider can handle international payrolls if you plan to expand across borders.

7. Access to Payroll Experts and Advice: Payroll isn’t just math—it requires deep knowledge of employment law, taxation, and statutory benefits. When you outsource, you get access to dedicated payroll specialists who can offer expert guidance on complex queries, like maternity leave, payroll audits, or backdated pay.

Partner with a provider that includes advisory sessions or support in their plan.

8. Integrated Payroll and HR Systems: Many payroll service providers offer integrated tools for HR management, time tracking, and accounting, which streamline operations and reduce double data entry, human errors, and payroll processing delays.

|

Efficiency Hack: Look for providers that integrate with your existing platforms like Xero, QuickBooks, MYOB, or Sage. |

9. Real-Time Reporting and Transparency: A good payroll service doesn’t keep you in the dark. Many offer dashboards and downloadable reports that help you monitor payroll costs, tax liabilities, and employee payment history in real time.

|

Analytics Tip: Use payroll data to make decisions about hiring trends, budget forecasts, or compliance gaps. |

10. Reliable Service and Payroll Continuity: Sick days, turnover, and holidays can delay in-house payroll operations. But outsourced teams guarantee consistent processing, even during internal disruptions.

|

Highlight: Choose a provider with backup teams and guaranteed processing windows—even on public holidays. |

1. Loss of Direct Control: Outsourcing can create a feeling of distance from the payroll process, especially when quick updates are needed. You may also have to rely on the provider’s timeline for urgent issues.

Tip: Choose a provider with self-service portals or fast support teams so you can request changes quickly.

2. Privacy and Data Concerns: Sharing sensitive employee data with third parties comes with cybersecurity and compliance risks, especially if the provider operates from a different legal jurisdiction.

Advice: Always check where your data is stored and processed. Ask for compliance with GDPR, CCPA, PIPEDA, or local laws.

3. Hidden or Additional Costs: Some providers charge extra for end-of-year reporting, custom reports, or employee offboarding. These charges can accumulate over time.

Pro Tip: Ask for a full breakdown of services included in your base package, and clarify what counts as an “extra.”

4. Dependence on a Third Party: If your provider experiences downtime, technical issues, or staffing shortages, your payroll could be delayed. This can impact employee satisfaction and trust.

Suggestion: Always ask about SLA (Service Level Agreement) terms, disaster recovery plans, and redundancy strategies.

5. Limited Flexibility for Special Requirements: If your payroll structure is complex, such as performance-based bonuses, international payroll, or project-based billing, some providers may not support it fully.

Customisation Tip: Consider a hybrid approach where you outsource routine tasks but manage specialised components internally.

Payroll outsourcing isn’t just a solution—it’s a strategic advantage. It helps streamline operations, reduce costs, ensure compliance, and scale with your business. However, it’s not without trade-offs. A thoughtful evaluation of your business size, structure, compliance needs, and data security priorities will help determine whether outsourcing is the right fit.

If payroll is consuming your time, budget, or peace of mind, it might be time to outsource.

Outsourcing payroll is more than a time-saver—it’s a strategic business decision. The benefits—cost savings, error reduction, improved compliance, scalability, and data insights—can transform payroll from a pain point to a powerful operational asset.

However, the decision shouldn’t be made lightly. Vet your provider’s expertise, tech stack, security certifications, and client support model thoroughly. The right partner will align with your business culture and growth trajectory.

Expert Closing Tip: The best outsourced payroll service is one that feels like an extension of your own team. Don’t settle for less.

At Aone Outsourcing Solutions, we offer comprehensive, scalable, and secure payroll outsourcing services tailored to businesses in the UK, Australia, Canada, and the USA. We handle everything—from weekly pay runs and benefits reporting to year-end tax submissions—so you don’t have to.

Transparent monthly pricing

Cloud-based payroll and HR dashboards

Dedicated support team for every client

Local and international tax compliance

GDPR, ISO, and SOC 2 security alignment

Book a free consultation today to discover how our payroll experts can streamline your processes and free up your internal team to focus on what matters most—growth and innovation.

Special characters are not allowed.

Special characters are not allowed.