GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Every business that uses GST in Australia must regularly submit its Business Activity Statement. Most small and medium-sized business owners encounter difficulties while understanding and completing the BAS system. You must wonder about what you should report on your BAS. Did I put the proper details in my statements? When is it due? Since delayed submissions and wrong data cause payment consequences, you need to complete the BAS process perfectly to maintain BAS compliance.

This guide explains how to prepare your Business Activity Statement (BAS). It features detailed instructions that start with BAS fundamentals, proceed through data review, and eventually lodge and pay your BAS. Follow these steps to understand your BAS, whether you prepare it yourself or work with a BAS lodgement service, or the BAS accounting services provider.

Australians must submit their Business Activity Statements through the BAS form to the ATO as their reporting tool for business taxes. A business reports GST, employee tax withholdings, income tax instalments, and pays fringe benefits tax alongside luxury car tax and fuel tax debt. Your business's duties toward the ATO or any outstanding debts become visible at specific points through Business Activity Statements.

The BAS serves double duty as a tax payment method and offers chances to claim input tax credits that help lower your GST responsibility. You qualify for a GST refund when your purchase amounts exceed what you earned. Good reporting practices help your business maintain financial stability because of their direct effect on cash availability. Businesses that want to stay on top of their finances often invest in professional BAS services or BAS accounting.

After considering your business size and turnover, the ATO sets your income BAS reporting frequency. When you register for GST and other tax obligations, the ATO starts assessing whether you need to report monthly, quarterly, or annually.

GST turnover over $20m usually relates to large businesses. Due to the large and complex nature of their financial activity, these businesses are required to report each month.

This is probably the most common and applies to most small or medium-sized businesses with a turnover of less than $20 million. Their turnover is not large enough for it to be practical to pay for the expense and collect it in enough time to make it worthwhile. The ATO provides standard lodgment dates: 28 October, 28 February, 28 April, and 28 July (unless advised otherwise), and it’s due four times a year.

Lodging annually: If you are a smaller business that self-registers for GST and your annual turnover is less than $75,000 or ($150,000 if you are a not-for-profit), you may need to lodge only annually.

|

Pro Tip: BAS will display what period it covers, so you know whether you’ve lodged for the right time frame. Another way to do this is to check your ATO online account for your assigned frequency. |

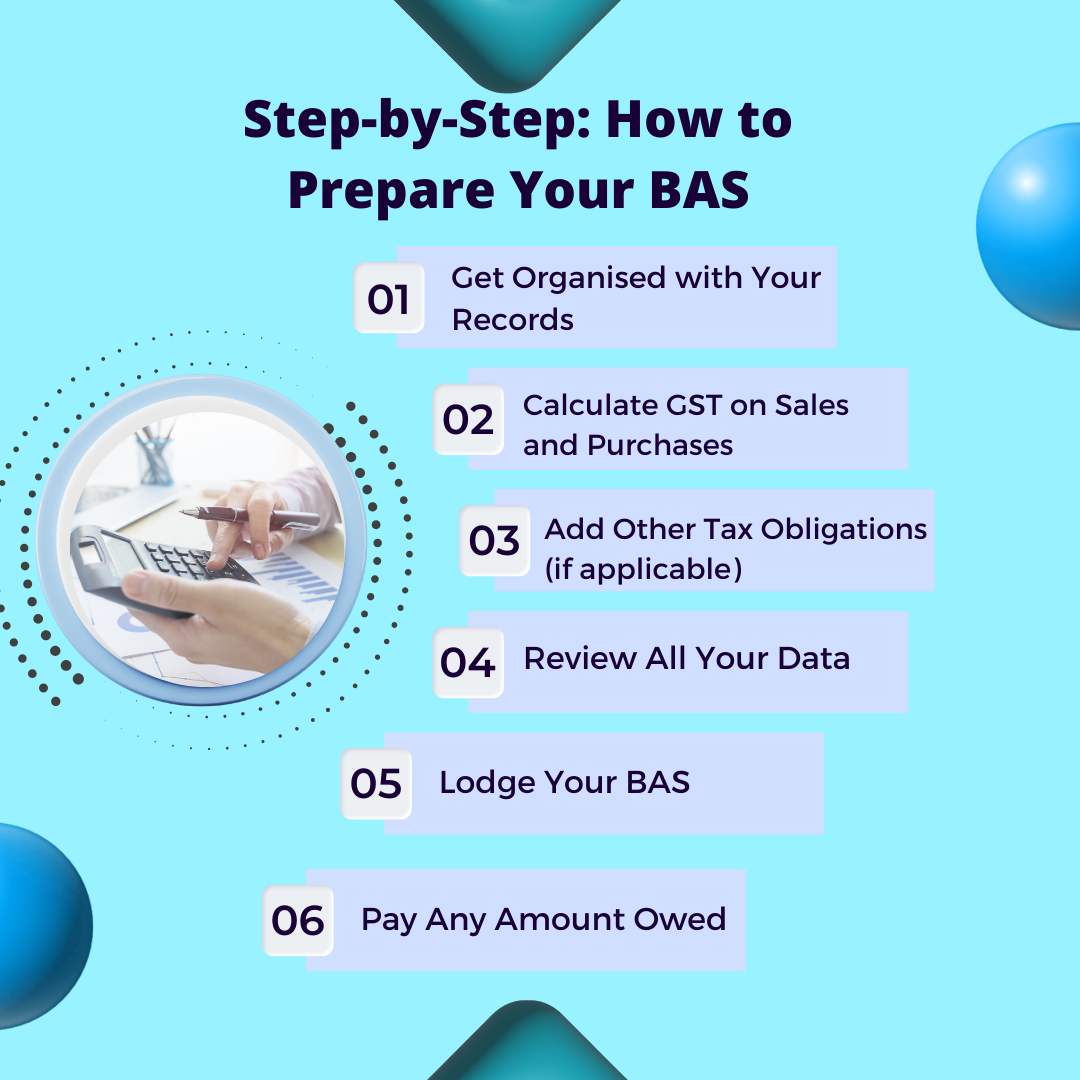

Let’s break down each step involved in preparing and lodging your BAS and preparing BAS statements, so you can handle it with confidence every time.

This step involves getting organised with your records. Good record keeping forms the basis of BAS preparation. So you need to be able to get all your financial documents on board for the period you’re reporting on. This includes all sales invoices that prove GST collected from customers and purchase invoices that prove GST paid to suppliers. Also, be able to produce bank statements to prove income and expenses, and payroll records to determine PAYG withholding tax if you have employees.

But if your company transfers or runs vehicles or machinery on fuel, hang on to those fuel receipts—you may be entitled to Fuel Tax Credits. It really adds a lot of paperwork, but to have these things carried out from the beginning will save you a lot of time and reduce a lot of stress, and help you avoid a lot of these things going wrong.

Making this step easier is using BAS accounting software like Xero, MYOB or QuickBooks Online. They also track your transactions, apply GST codes and generate the report that can be used in the preparation of BAS.

GST Collected (or also called Output Tax): This is the amount of GST you have calculated, charged to your customers and should have then handed over to the government (in other words, the GST you have charged your customers on taxable goods and services). For instance, had you sold goods amounting to $11,000 (including GST), you would have collected GST of $1,000.

GST Input Tax Credits: This is the amount of GST you have paid on purchases made in the business. For instance, if you purchased a laptop for $1,100 (including GST), then you would have paid GST (up to $100), which could be claimed as a credit.

Now, subtract GST Paid from GST Collected:

|

Net GST = GST Collected – GST Paid |

Tip: This can be done automatically in your accounting software from the ‘GST Summary’ or ‘Activity Statement’ report. Verify the numbers always against the documents for accuracy.

It is, therefore, crucial to note that BAS is much more than just GST. In your individual circumstances, you might also have to declare:

PAYG Withholding: If you have employees, you will be required to report the taxes you have deducted from their wages or salaries. This information must be current and supported by actual ATO tax tables.

PAYG Instalments: In addition to normal tax payments, the ATO may require you to pay your tax in instalments if your earnings exceed certain limits. These values are estimates of previous years’ tax returns.

Fuel Tax Credits: If you use fuel to operate your machinery or vehicles used in business, whether on or off road, you can have the credit you need.

It’s essential to make sure you’re including only the taxes that apply to your business. Not all businesses need to complete every section of the BAS form. Getting help from a BAS accounting services provider may help ensure accuracy and compliance.

It’s important, therefore, that you do a second guess on all the BAS. It goes beyond simple errors arising from typos, though it may sound trivial, to more serious problems like audits, penalties or cash flow problems.

|

Tip: To identify such disparities, refer to a reconciliation report or a BAS report provided by the accounting software. It is probably more practical to identify mistakes before lodging than after lodging. |

After confirming everything is in order, you will lodge your BAS. There are several lodging pathways available:

Online, via the ATO Business Portal: Most businesses find it quick and convenient.

Via your accounting software: If your software is connected to the ATO, it can take just a few clicks.

Through a BAS or tax agent: Agents can offer you extra time to lodge and pay.

On a paper form: The hard way, actually—it is still accepted, but is slower and less secure.

Ensure you lodge well in advance of the due day: a non-lodging penalty can apply after this date. The penalty rises with the length of the time your BAS remains outstanding, along with interest on any outstanding amounts. That’s why many businesses opt for a reliable BAS lodgement service.

Upon successful lodgment, a summary will proclaim whether you owe or are due a refund. If you do owe the ATO money, then make a payment by the payment date to avoid incurring interest.

If it seems daunting, seek help. Instead, take action to address the debt problem. The ATO offers payment plans for small businesses with temporary cash-flow problems. It's better to be proactive than to let the ATO come to you.

Preparing a BAS is time-consuming and complex if you are busy with other business tasks.

Nothing is more reassuring than having a registered BAS agent do all that work for you.

The advantages include:

At Aone Outsourcing Solutions, we help an Australian business stay compliant and avoid penalties. Relax while we prepare your BAS and payroll reports and assist you on tax time with ease.

What if I submit my BAS too late?

There may be penalties and interest charges from the ATO for late lodgement. It may also affect your BAS compliance history and lead to future scrutiny. So if you think you will be late, notify ATO as early as possible.

Q2. Can I lodge BAS myself without a BAS agent?

If you're confident, then you can definitely lodge using ATO portal. However, a BAS agent would help you to correct errors and save time. A BAS agent will also ensure that your lodgement is fully compliant.

Q3. What if I made an error on a prior BAS?

In the majority of cases, minor errors can be fixed on the next BAS. Greater mistakes usually mean needing to adjust the original BAS. It's advisable to turn to a BAS lodgement service or BAS services provider for complete accuracy when making corrections.

Q4. Do I have to lodge a BAS if there were no sales or purchases?

Yes, a 'nil BAS' has to be lodged for compliance. However, it is possible that non-lodgement will attract ATO penalties.

Q5. How long am I to keep records for BAS?

The ATO requires you to keep BAS accounting records for 5 years. Whether electronic or hard copy, all records must be available.

Special characters are not allowed.

Special characters are not allowed.