GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Running a business in Australia comes with many responsibilities, and one of the most crucial yet time-consuming tasks is managing your tax and financial reporting. Regardless of size, every business must follow rules from the Australian Taxation Office by fulfilling its Business Activity Statements (BAS) obligation. Businesses must submit their tax duties, which include Goods and Services Tax (GST) and Pay As You Go withholding, together with other tax responsibilities, to BAS lodgement in Australia. Business leaders often find it hard to maintain daily operations and meet all required regulations.

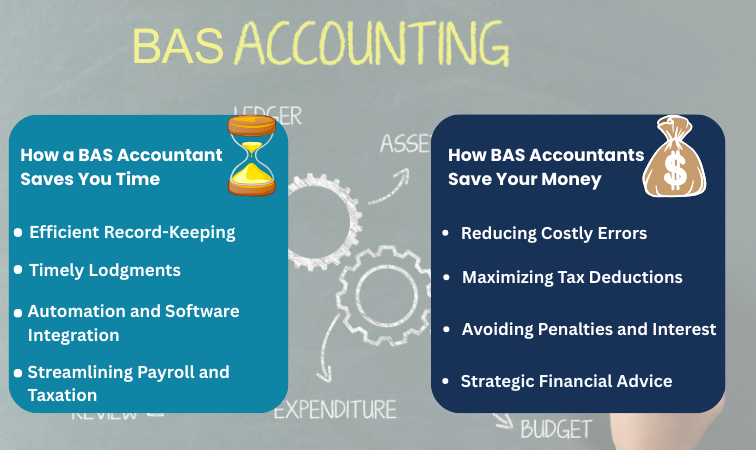

Carrying out incorrect BAS preparation activities creates various unfavorable consequences, including tax payment burdens for businesses whose cash flow suffers. Because of their expertise, professional BAS accountants assist multiple businesses in Australia. The expertise of a proficient BAS accountant produces threefold benefits: it secures regulatory compliance while enabling organisations to use their resources more efficiently, minimises tax fees, and enhances financial capabilities. Outsourcing BAS agent services benefits all business types, including those operating as sole traders, startups, or well-established entities.

We will analyse BAS accountants' vital work and systematise financial management methods as well as the benefits Australian companies receive from BAS services for better operational performance and increased profitability.

Every Australian business operating under the Business Activity Statement Australia requirement needs to regularly report to the Australian Taxation Office through this critical document. It includes:

A business needs accurate BAS preparation to ensure correct tax payments in order to avoid paying too much or too little. Excessive tax payments lower your operational funds, yet insufficient tax payment triggers ATO investigations that result in fees, monetary penalties, and interest charges. Late BAS lodgment by businesses leads to ATO penalties that affect their financial steadiness. Success in BAS lodgement requires Australian businesses to master tax regulations, financial reporting standards and best practice financial management principles. The value added by working with BAS accountants with experience is their ability to manage complete BAS preparation processes with precision and compliance guidelines.

1.Efficient Record-Keeping: Your financial records receive accurate organisation and constant updates through the BAS accounting responsibilities of the specialist. There is an excessive task when business owners handle invoices, receipts, and business transactions by hand due to their multiple operational commitments.

A BAS accountant arranges financial records into categories while maintaining strong record maintenance, which keeps required lodgement data accessible. Early preparation by eliminating finishing tasks at deadline time helps protect your lodgement from delays or errors.

2. Timely Lodgments: Businesses submitting their BAS documents late must pay fines and interest charges. The BAS lodgement Australia schedule includes strict deadlines for which a BAS accountant serves to protect your business through scheduled date-tracking for prepared and timely BAS filings. Numerous businesses experience difficulty when it comes to meeting tax deadline requirements especially for entities required to report by quarter or month.

A BAS accountant not only gives you deadline reminders but also provides advanced completion of required documentation to stay clear of taxation penalties. The BAS preparation capabilities of these professionals enable smooth publication of reports, which leads to hassle-free compliance duties for business administrators.

3. Automation and Software Integration: The BAS accounting software Xero, QuickBooks, and MYOB enables financial professionals to automate their calculations, track financial transactions, and reduce manual data entry. Advanced financial reporting occurs more quickly, and human mistakes are reduced when this system is used. Companies using outmoded bookkeeping methods spend long periods manually adding data, which produces more opportunities for errors and reduces operational effectiveness.

BAS accountants establish a system of advanced software that performs automated financial management so owners can dedicate time to business expansion instead of administrative work. Through their competencies they establish cloud-based solutions to track business financials in real time for expenses as well as cash flow and tax requirements.

4. Streamlining Payroll and Taxation: A BAS accountant assists businesses with their staff by correctly calculating and reporting PAYG withholding requirements. BAS accountants ensure compliance standards that prevent payroll penalties and related compliance issues.

The payroll management is more than salary payment work since it needs precise documentation for tax requirements, superannuation payments and legally accepted deductions. The BAS accountant ensures your business stays compliant by handling payroll tax reports.

Reducing Costly Errors: BAS submission in Australia might result in both excessive taxes and penalties. A BAS accountant evaluates your financial data accurately and prevents monetary losses for your business. Various business errors stem from incorrectly categorising business costs, failing to report complete revenue numbers, and disregarding vital tax deductions. Before submitting a BAS to the government, a professional BAS accountant must thoroughly examine all financial records.

Maximizing Tax Deductions: A BAS accountant possesses a deep understanding of the tax rules as well as available deduction opportunities for businesses. BAS professionals find all deductible items which help you reduce your tax responsibility. Business owners who do not understand tax regulations normally fail to use available tax-saving methods. A BAS accountant evaluates your financial records to determine all deductible expenses, which range from business assets to transportation costs and office materials and professional assistance.

Avoiding Penalties and Interest: Payment of financial penalties becomes necessary when businesses fail to follow tax laws. The role of a BAS accountant includes accurate, timely filing of documents, which avoids additional financial costs and penalties. The Australian Taxation Office enforces fines for businesses that fail to submit reports on time and penalises incorrect tax filings and insufficient tax payments.

Strategic Financial Advice: A BAS accountant provides financial advisory services for improved cash flow management and cost reduction, and strategic planning toward financial stability. Professional expertise from BAS accountants helps organisations make better business choices. The inability of many business owners to handle their cash flow properly causes them serious financial difficulties. As part of their services, a BAS accountant creates financial forecasts that support resource allocation and help business owners plan for tax payments and save costs.

When selecting a BAS accountant, consider the following:

Qualifications and Registration – They are a registered BAS agent with the Tax Practitioners Board (TPB) and offer professional BAS agent services.

Industry Experience – A BAS accountant familiar with your industry can offer tailored advice and tax strategies.

Aone Outsourcing Solutions provides formal BAS services to small and large businesses. Our BAS accountants provide complete BAS support, including preparation and lodgement services, and follow all ATO requirements. Our efficient systems and advanced accounting software enhance customer financial efficiency and tax results through our specialised knowledge of industry sectors.

With Aone BAS Services, you can focus on growing your business while we manage your tax obligations efficiently and cost-effectively.

An Australian business must have a BAS accountant as an essential partner who ensures tax compliance and saves time and financial resources. Partnering with BAS professionals at Aone Outsourcing Solutions will free your business from technical and financial needs and allow you to prioritise business expansion. Hiring an expert BAS accountant creates an economically beneficial situation that delivers efficiency and accuracy and brings total peace of mind.

Contact Aone Outsourcing Solutions now to get expert BAS services because our team can handle all your tax requirements.